What is American Express (AMEX) and what does this mean for Flutterwave merchants?

Updated 8 months ago

American Express (AMEX) is a globally recognized card network known for its premium services and extensive benefits. With this partnership, Flutterwave merchants in Nigeria can now accept payments from American Express cardholders, expanding their customer base and providing more payment options.

However, please note that not all merchants are eligible to accept payments from AMEX cards. To qualify.

Your business must not be listed under Flutterwave's prohibited businesses.

Your Flutterwave account must be fully verified.

Additionally, AMEX does not permit transactions from specific merchant categories. These include:

Bail and Bond Payments

Non-Financial Institutions - Foreign Currency, Non-Fiat Currency (e.g., Cryptocurrency), Money Orders (Not Money Transfer), Account Funding (Not Stored Value Load), Travelers Cheques, and Debt Repayment

Charitable Social Service Organizations

Real Estate Agents and Managers

Computer Network Information Services

Door-To-Door Sales

Dating Services

Government - Owned Lotteries (US and Non-US Regions)

Government - Licensed Online Casinos (Online Gambling) (US Region only)

Security Brokers Dealers

Financial Institutions - Merchandise, Services, and Debt Repayment

Direct Marketing - Outbound Telemarketing Merchant

Direct Marketing - Inbound Teleservices Merchant

Drugs, Drug Proprietaries, and Druggist Sundries

Drug Stores and Pharmacies

Political Organizations

Direct Marketing - Travel-Related Arrangement Services

Cigar Stores and Stands

Travel Agencies and Tour Operators

Massage Parlors

Money Transfer Services

If your business falls under any of these categories, you will not be able to process AMEX card transactions.

How can I receive international payments from AMEX cards?

To receive international payments from American Express (AMEX) cards, follow these steps:

Log into your Flutterwave dashboard.

Navigate to your settings.

Go to Business Preferences.

Select Payment Methods.

Locate the option for International Cards.

Click on the Request Access button to request to be enabled for the acceptance of international cards.

Once your request is approved, you can receive international payments from cardholders including AMEX cardholders.

What are the fees and charges for accepting American Express cards?

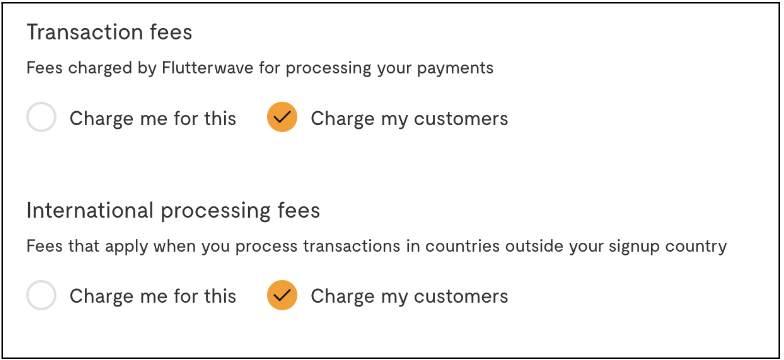

A 4.8% transaction fee applies to payments made with international American Express cards, while a 2.0% fee applies to payments made with local American Express cards. You can absorb the transaction fee or pass it to your customers. To pass the fees to your customers, simply log into your dashboard and follow the steps below:

Navigate to Settings

Click on Business preference

Go to Fee settings

Enable "charge my customers"

How long does it take to process and settle transactions made with American Express cards?

Transactions are processed instantly, while settlement occurs on a T+5 basis, meaning funds are settled within five days.

Additional details required for making a transaction with an American Express card?

When making a transaction with an international American Express card, the following details are mandatory:

Cardholder name

Phone number

Billing details

These details ensure the transaction is processed smoothly and securely.

How are disputes handled for American Express transactions?

If you need to log a chargeback request for an American Express transaction, please contact your bank to file a complaint regarding the transaction in question. Submit any relevant evidence that supports your chargeback request. For a step-by-step guide on how to log a chargeback, you can refer to the detailed breakdown provided here.

Please note that these timelines are estimates and can vary based on the nature and complexity of the dispute. Also, note that a dispute fee of $38 or its equivalent is charged for international chargebacks.

What are the benefits of accepting American Express cards for my business?

In addition to Mastercard, Visa, Verve, and Discover cards, your customers can now use their American Express cards to make payments, allowing you to cater to a broader audience.

How secure is it to accept American Express cards on Flutterwave?

Flutterwave ensures high-level security for all transactions. We support 3D Secure (3DS) authentication, which protects both merchants and customers from fraudulent activities. Additionally, Flutterwave is PCI-DSS certified, meeting the highest standards of security for processing card transactions.

We'd like to hear from you

Suggest the type of support articles you'd like to see

Still need help?

Get in touch if you have more questions that haven’t been answered here