Updated Merchant Services Agreement (MSA)

Updated 7 months ago

We have updated our Merchant Service Agreement (MSA) to introduce two key service models (ISO and PayFac) that define how we work with you to process payments and to align with regulatory standards and acquiring bank requirements. This FAQ explains what’s changing, what it means for your business, and what you need to do.

Understanding the Service Models

What are the two new service models introduced in the merchant service Agreement?

We’ve introduced:

ISO (Independent Sales Organisation Model); and

PayFac (Payment Facilitator) Model.

These models define how Flutterwave operates in relation to you as a merchant, particularly around who is responsible for Onboarding, Compliance, Payment Processing, and Settlement.

What is the ISO model, and how does it work?

Under the ISO Model:

Flutterwave serves as a referral or reseller partner.

We introduce your business to an Acquiring Bank, which becomes your primary payment service provider.

The Acquirer is responsible for:

Processing your transactions

Performing compliance and risk checks

Settling funds directly to your bank account

You will sign two agreements:

A direct agreement with the Acquiring Bank.

Our Merchant Service Agreement, which covers your relationship with Flutterwave as a referral partner

What this means for you:

Flutterwave is not directly responsible for settlement or ongoing compliance; the Acquirer is responsible.

If there are issues with payment delays or fraud checks, these will be managed by the Acquirer, not Flutterwave.

What is the PayFac model, and how does it work?

Under the PayFac model;

Flutterwave is your primary service provider.

We manage the entire payment lifecycle, including:

Onboarding and verifying your business

Processing transactions

Monitoring risk and fraud

Settling payments to your account

Ensuring compliance with regulations from payment schemes, regulators, and other key stakeholders.

What this means for you:

You will only need to sign the Flutterwave Merchant Service Agreement.

Flutterwave is fully responsible for your compliance, settlement, and ongoing transaction monitoring.

We may perform a regular review of your business activity to ensure compliance with regulatory obligations.

Why am I being asked to accept a new MSA and Acquirer Agreement?

You are being asked to accept the new MSA because of the changes we made to align with the updated regulatory and compliance requirements. Additionally, if your account is under the ISO model, you are required to accept a separate Acquirer Agreement from our acquiring partner to continue processing payments on our platform.

What is the Acquirer Agreement?

The Acquirer Agreement is a legally binding contract between you and our acquiring partner. It outlines:

The terms and conditions governing your payment processing activity.

Our Acquiring Partners' rights and responsibilities as your Acquiring bank

Your obligations as a merchant using their services via Flutterwave

This agreement is mandatory if you are onboarded under the ISO model.

Who is an Acquirer?

An Acquirer (also known as an Acquiring Bank or Merchant Acquirer) is a financial institution or bank that processes credit or debit card payments on behalf of a merchant.

They enable merchants to:

Accept payments from customers using cards (e.g., Visa, Mastercard, Verve).

Settle those payments into the merchant’s account.

Route transactions securely through card networks.

Acquirers play a critical role in ensuring that card transactions are processed, settled, and protected.

Flutterwave partners with various acquirers across different countries to enable card payment processing for its merchants.

Can I negotiate or edit the Acquirer Agreement?

No. The Acquirer Agreement contains standardized terms and conditions issued by our acquiring partner. These terms apply to all merchants using this service and, unfortunately, can’t be modified on an individual basis. Acceptance of the agreement is required to continue Flutterwave’s payment services under the ISO model.

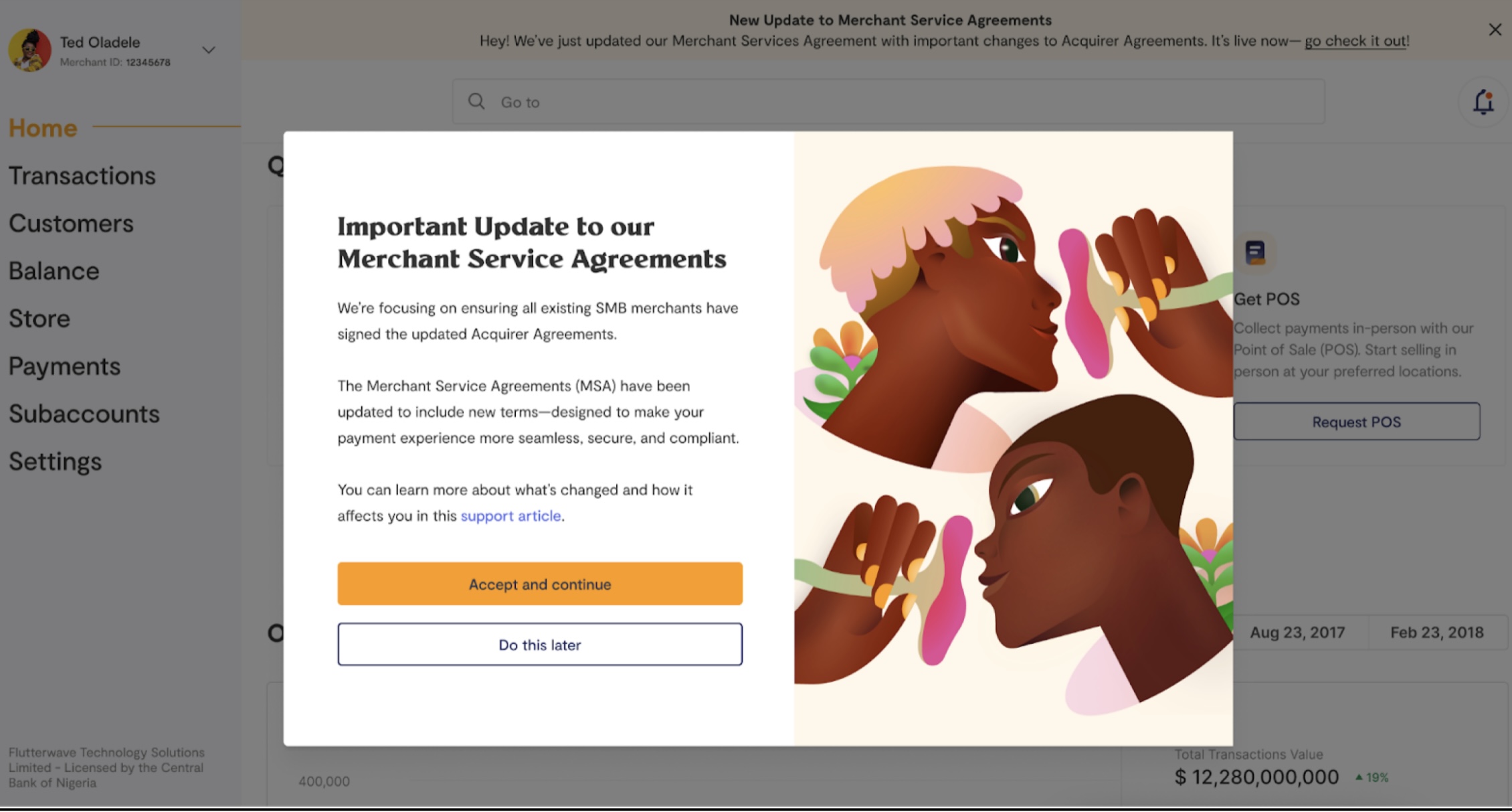

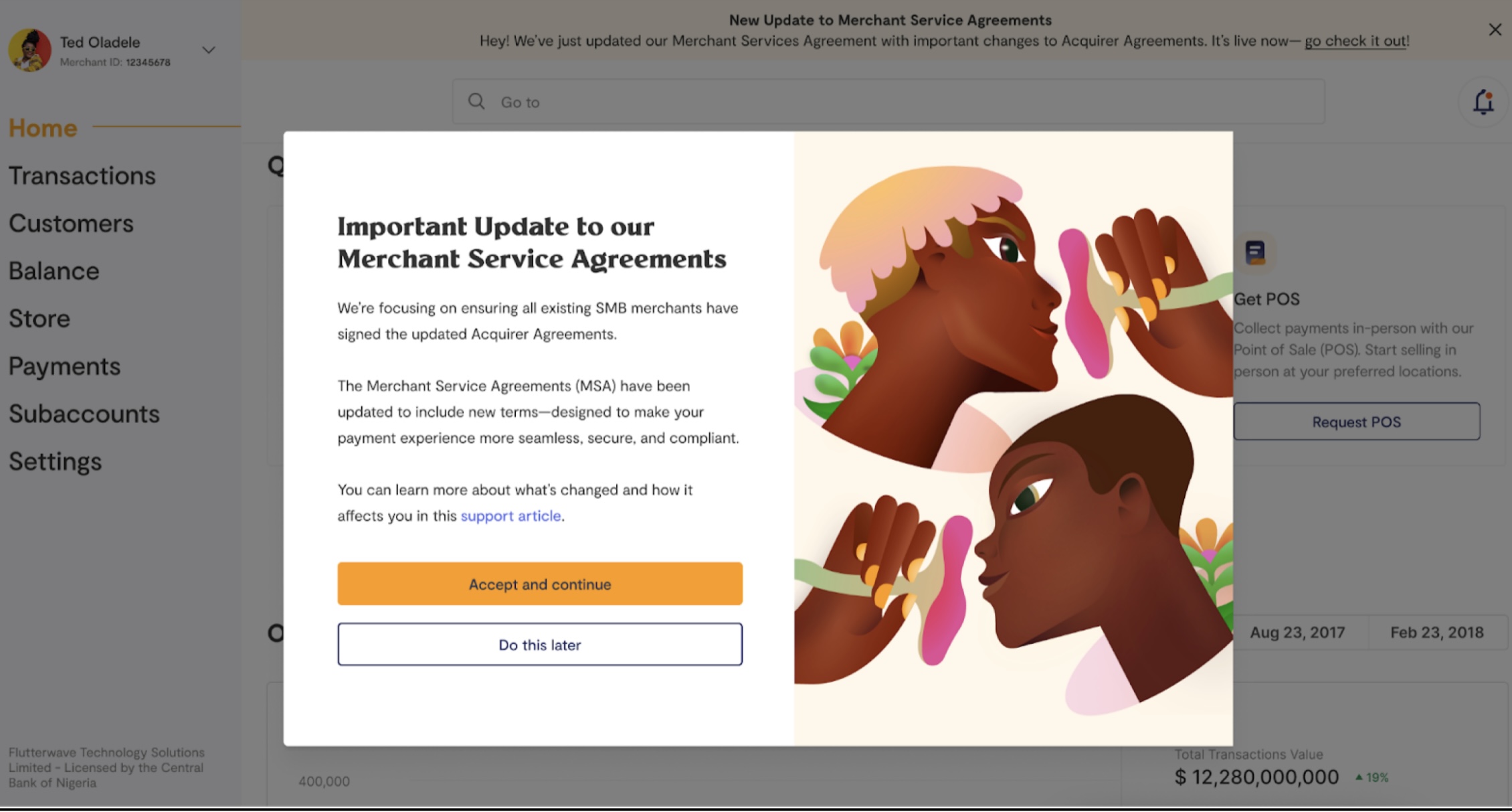

What happens if I don’t accept the updated agreements?

Until you accept the new MSA and Acquirer agreement, you will continue to see a persistent prompt on your dashboard.

If you do not accept the agreement by the given deadline, this will lead to an automatic acceptance.

How do I accept the Agreement?

Log in to your Flutterwave dashboard

You will see a prompt to review the updated MSA and Acquirer agreement

Click on “Accept and continue”.

I’ve accepted the agreements, do I need to do anything else?

No, once you accept the updated terms, no further action is required on your part. Your acceptance is automatically logged and stored for future reference.

Why did Flutterwave introduce these two models?

We made these changes to:

Align with global payment industry standards, used by major payment processors.

Clearly separate roles and responsibilities between Flutterwave, Acquirers, and Merchants.

Improve risk management and fraud detection by using the model that best suits your business.

Offer flexibility to tailor services based on your transaction volume, industry, and risk profile.

Do these changes affect pricing or fees?

For now, your current pricing remains unchanged. If there are any changes in the future, we will notify you in advance.

We'd like to hear from you

Suggest the type of support articles you'd like to see

Still need help?

Get in touch if you have more questions that haven’t been answered here