Value Added Tax (VAT) for Flutterwave Merchants in Nigeria

Updated 1 month ago

What is Value Added Tax (VAT)?

VAT is a consumption tax charged on the supply of goods and utilization of services in Nigeria except those expressly exempted and listed in Parts 1 and 11 of the First Schedule to the Value Added Tax Act. You only have to pay VAT when you buy goods or use a service. Here’s an article from the FIRS that gives a good breakdown of VAT and its application in Nigeria.

Who does the VAT apply to and what is it charged on?

VAT applies to merchants whose signup country is Nigeria, and it is charged on fees for transfers, local and international transactions.

How is VAT calculated?

VAT is calculated at 7.5% of all Flutterwave fees, including transaction fees, transfer fees, and international processing fees.

Here's an example:

Let’s assume your customer completes a ₦10,000 transaction. With a 1.4% transaction fee (₦140), the applicable VAT will be ₦10.5, 7.5% of the fee (₦140).

Today, if you pass on the transaction fee to your customers, you get settled ₦10,000 into your account; if you pay the transaction fee, ₦9,860 (N10,000 - N140) is settled into your account.

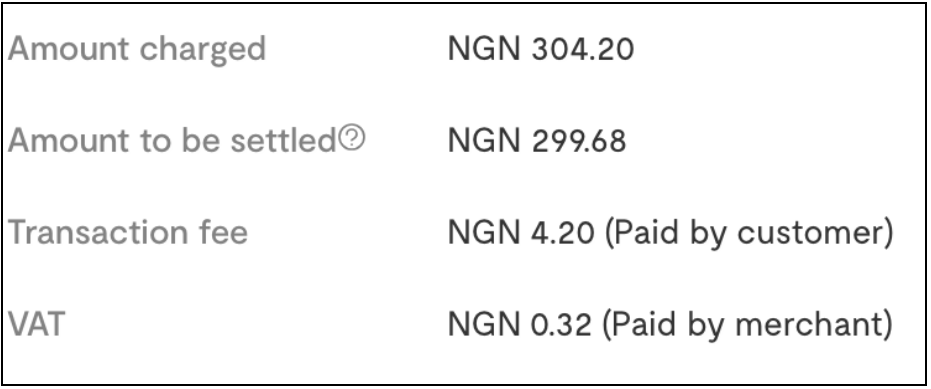

With VAT (₦10.5), the amount settled to you is reduced by N10.5. The N10.5 collected in VAT is directly remitted to the tax authorities.

Who bears the VAT charge?

By default, you are charged VAT, and the amount is remitted to the tax body of the Federal Republic of Nigeria. Unlike the transaction fees, you can not pass on the VAT charge to your customers.

Will I still be able to pass other fees to my customers?

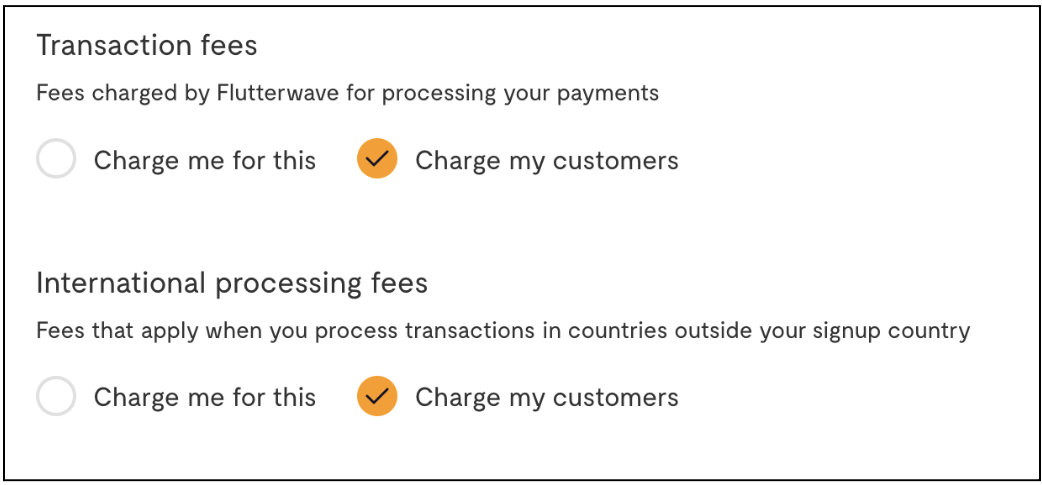

Yes, you still have the option to pass on transaction fees and international processing fees. To do this, log in to your dashboard and follow the steps below:

- Navigate to Settings

- Click on Business preference

- Go to Fee settings

- Enable "charge my customers"

How will I know when VAT has been charged? Will I see the Value Added Tax in my transaction report?

Value Added Tax will be displayed on all transactions. You can find the VAT information in your transaction reports which can be downloaded from your dashboard. To download your transaction statement:

- Log in to your dashboard

- Navigate to Transaction

- Click on the download button to download your transaction statement.

Have any suggestions?

Submit a request on the type of support articles you'd like to see