How we handle chargebacks

Updated 19 months ago

Refunds and chargebacks are an almost inevitable part of accepting payments online. They can occur for various reasons, including but not limited to: successful charge but value/service not provided, the cardholder not recognizing the charge on their bank statement, fraudulent transactions, etc. However, it is your responsibility to take appropriate actions to prevent or respond to them.

Please note that a dispute fee of $38 or its equivalent is charged for international chargebacks. This article guides you through the step-by-step process of managing a chargeback on your dashboard.

What are chargebacks?

Chargebacks allow customers to dispute transactions and secure a refund for their purchase. A chargeback voids a card transaction, meaning the transaction amount previously credited to the merchant’s account will be removed and sent back to the customer. Chargebacks are different from refunds. For a refund, the consumer contacts the business directly, while for chargebacks, the customer asks the bank/processor to forcibly remove funds from the business’s account and return them.

How Flutterwave handles Chargebacks

The process for a chargeback is as outlined below:

The customer’s issuing bank initiates a chargeback request through Flutterwave’s acquiring bank.

The acquiring bank debits the chargeback value from Flutterwave’s account.

Flutterwave sends the chargeback to the merchant, requesting proof of service/value and supporting documents. The expected response timeline from the merchant is 48 hours from the date the request was sent by Flutterwave.

Once the supporting documents are received, Flutterwave responds to the acquiring bank based on the merchant’s response.

If the evidence submitted is accepted, the issuing bank is debited and the credit is passed on to the merchant's settlement. Otherwise, the chargeback transaction is accepted.

How to view and manage your chargebacks

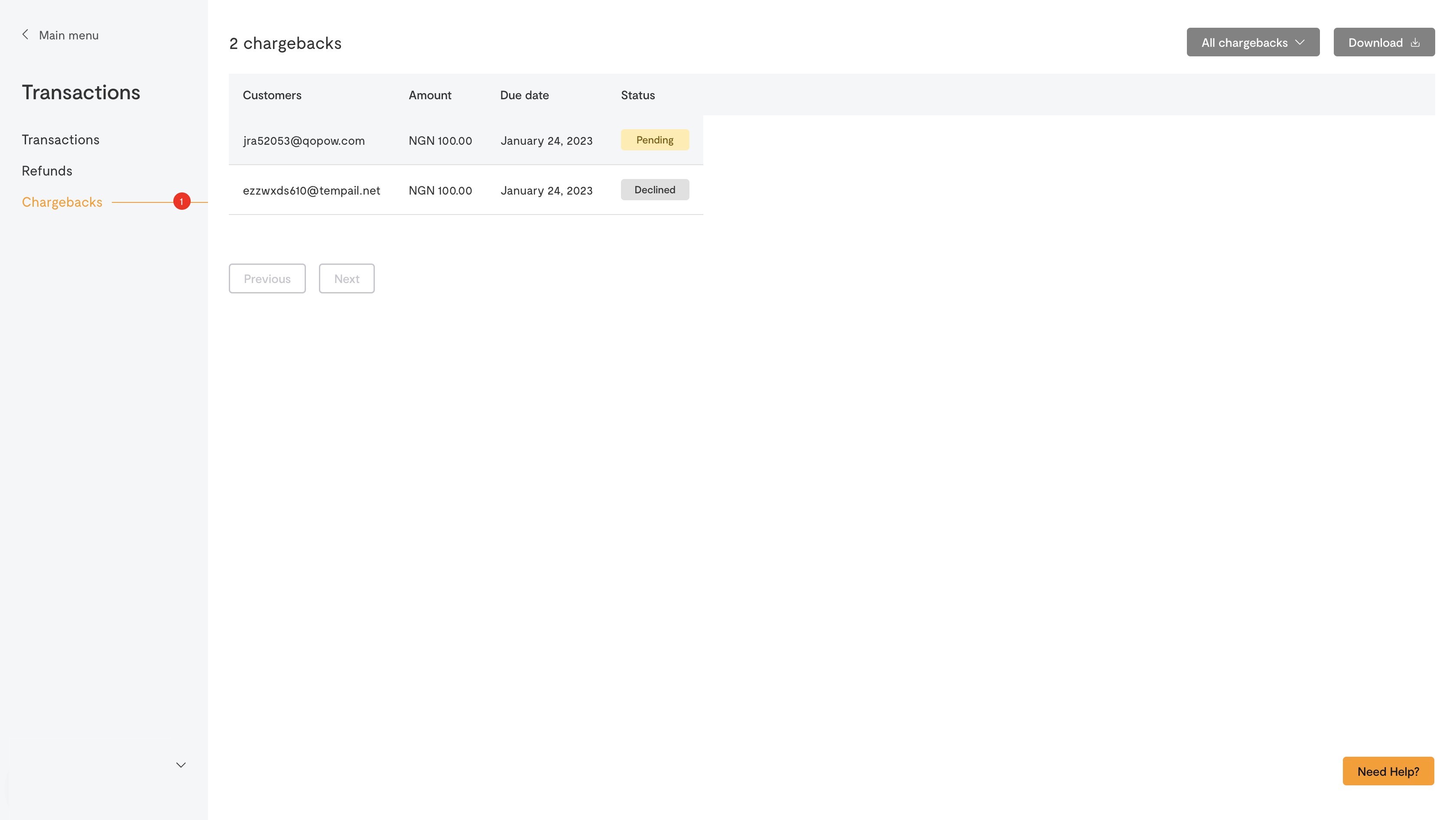

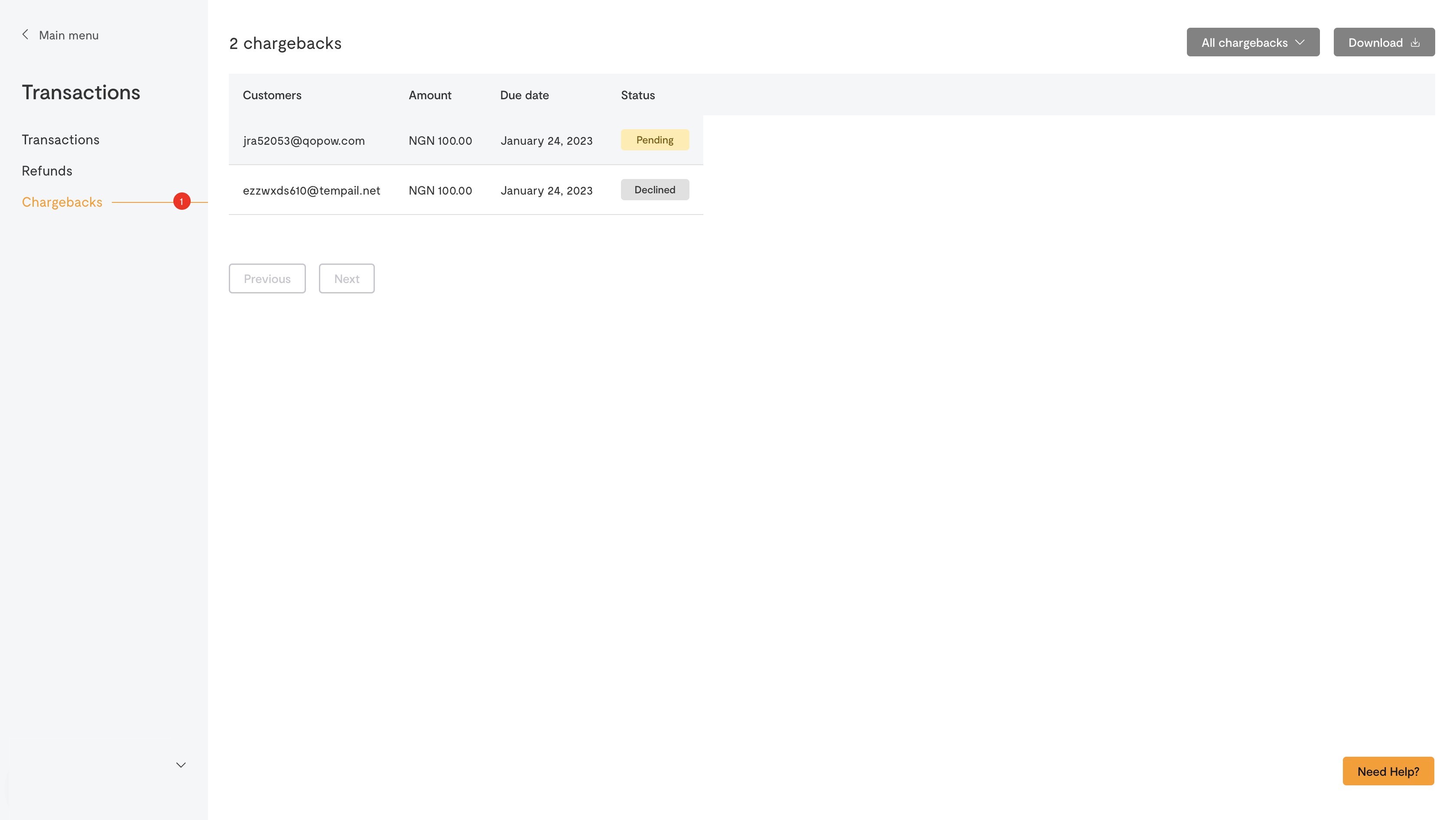

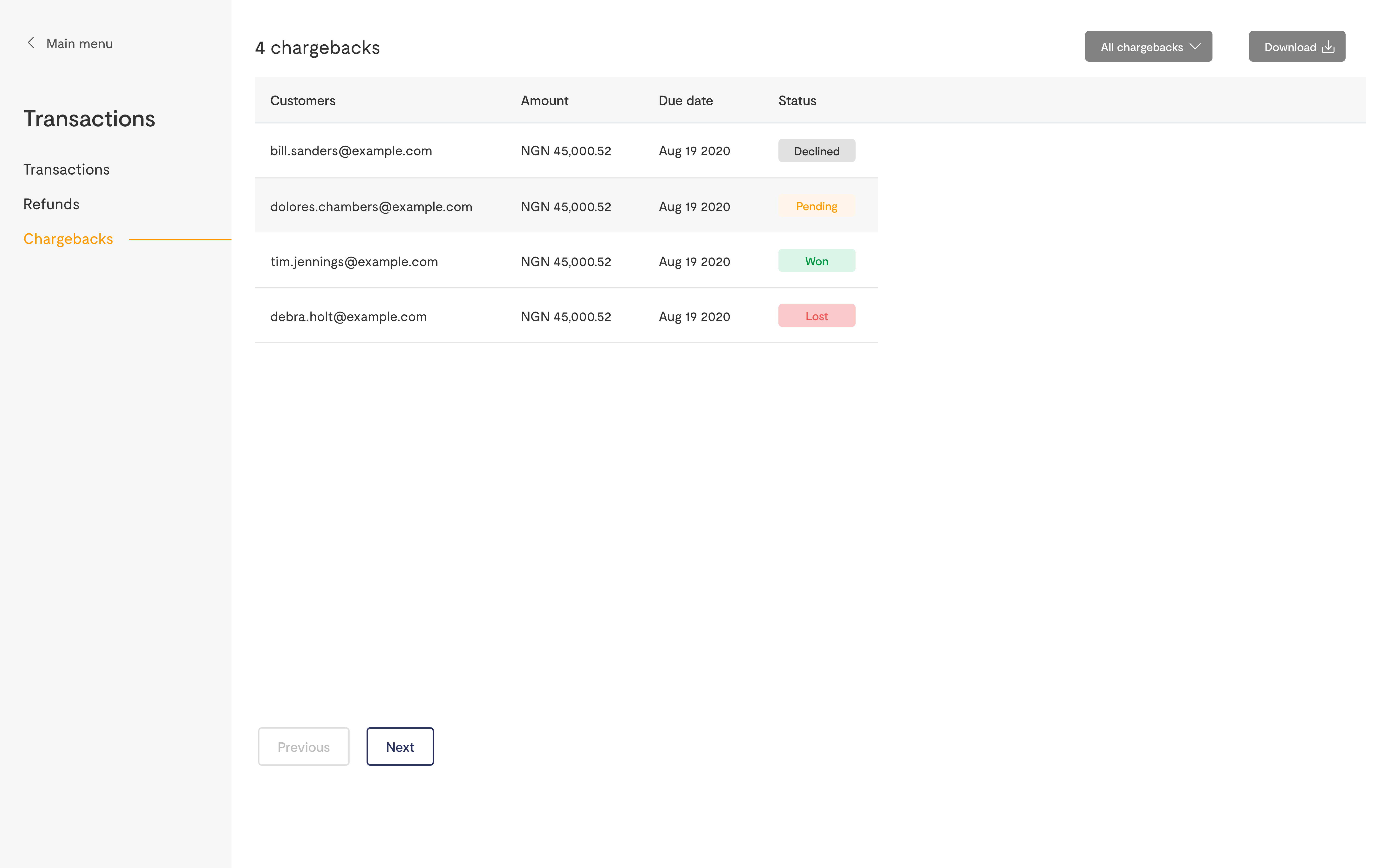

All chargebacks logged against you will be displayed within the Chargebacks tab. New chargebacks will have the status: Pending. You will receive an email notification when a chargeback is logged against you. To view logged chargebacks:

Login to your Flutterwave dashboard

Click “Transactions” on the left side of your dashboard, then click “Chargebacks”.

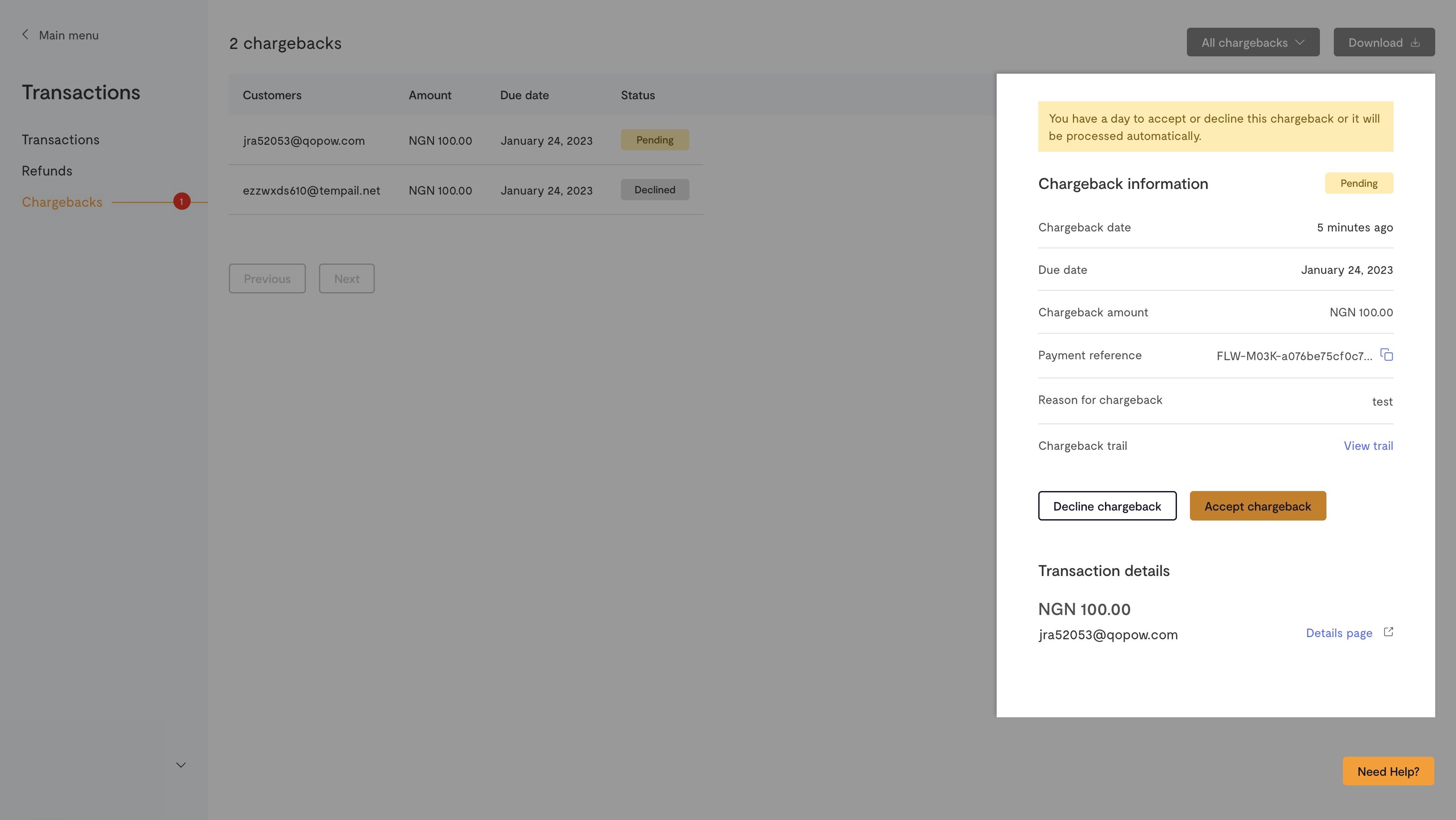

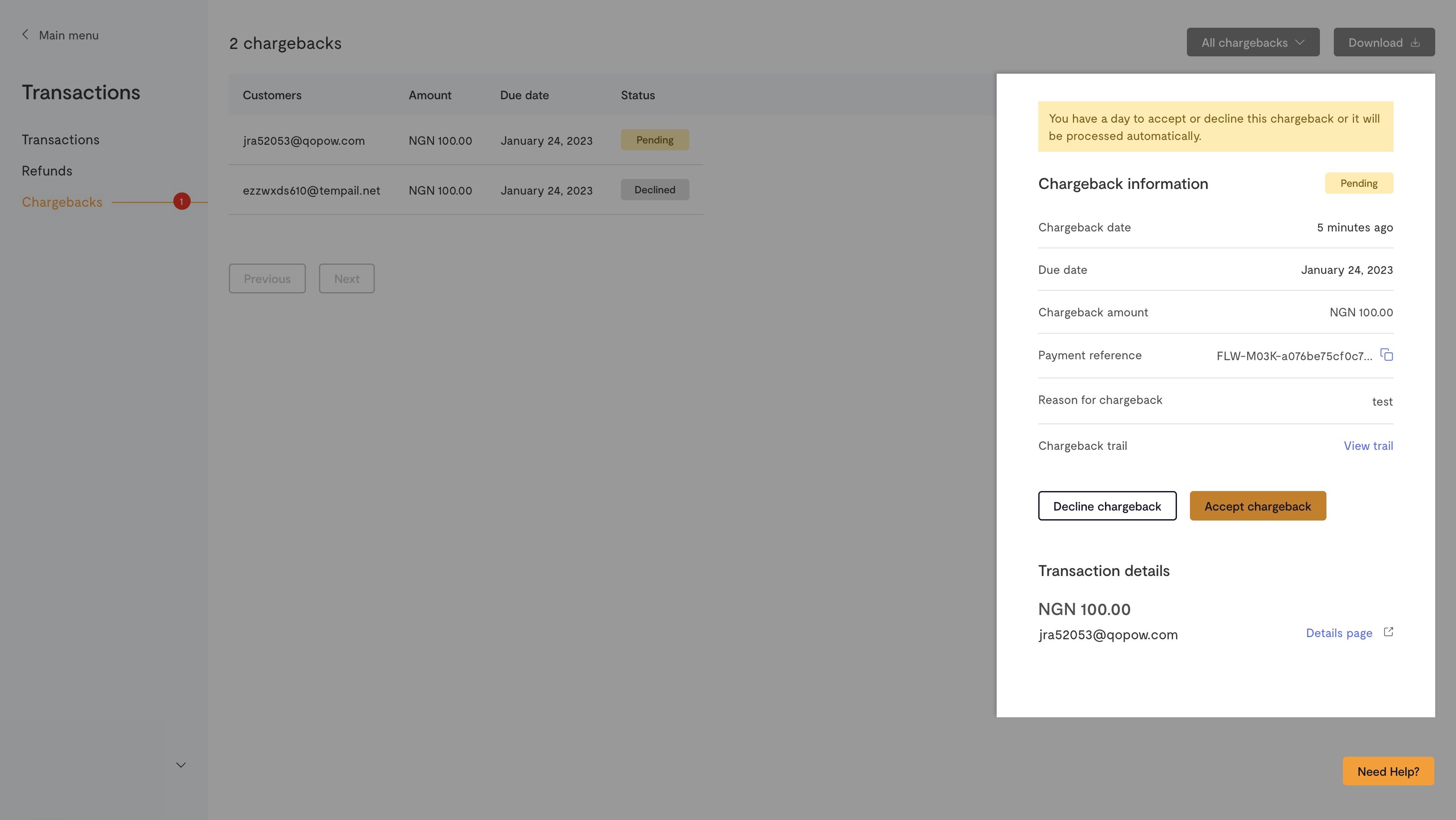

Click on the specific chargeback to see its details. You can also click the “Details” page to see more information about that transaction.

You can choose to either decline or accept the chargeback.

Accepting a chargeback

If you accept the chargeback, the transaction amount will be deducted from your balance and refunded to the customer. Do not refund a transaction that has already been logged as a chargeback, or the customer might receive the transaction amount twice. The funds have been temporarily withheld from your settlement, pending the outcome of the chargeback resolution process.

However, if you have already refunded the customer before seeing the chargeback notification, you can decline the chargeback and provide proof of the refund.

Decline Chargeback

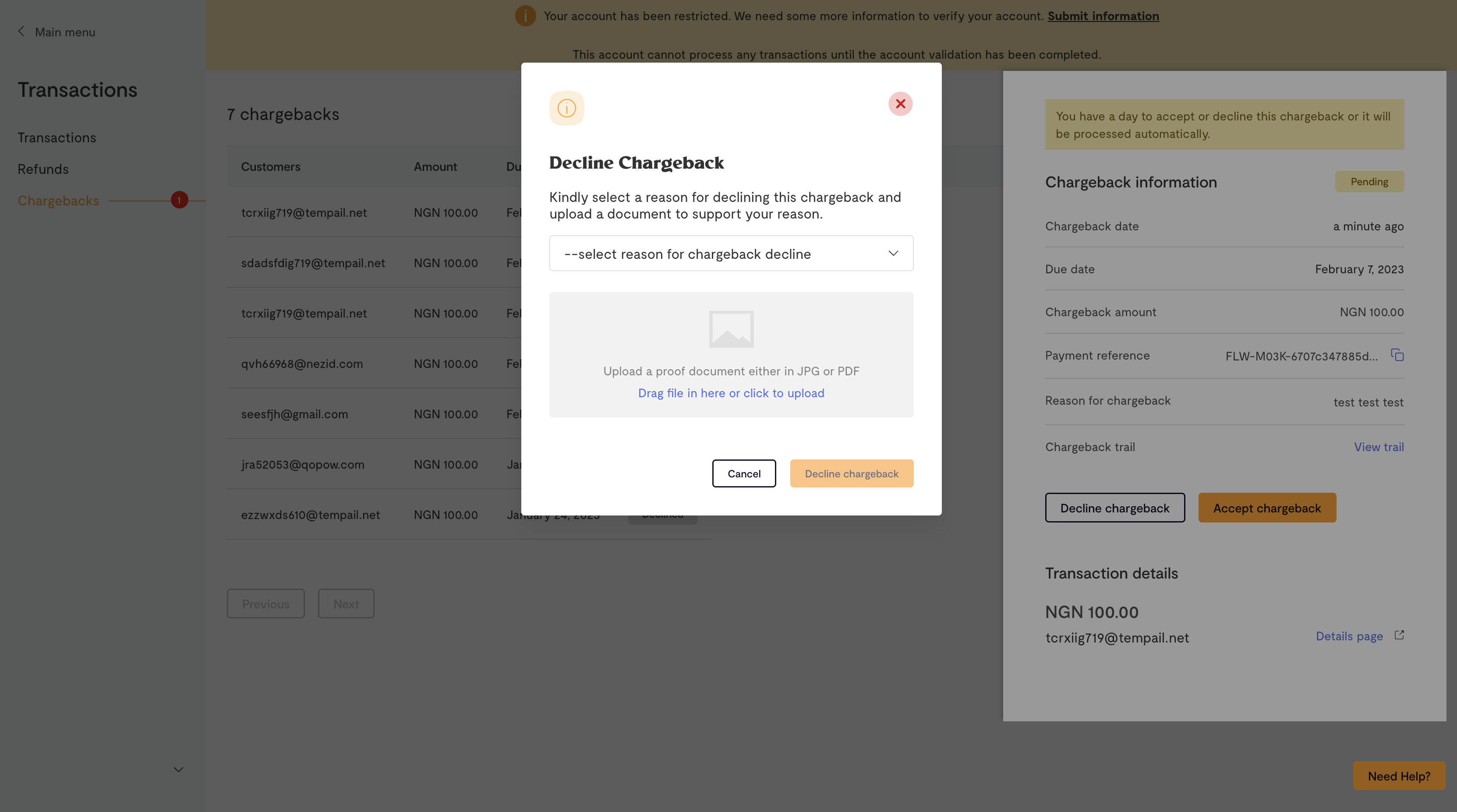

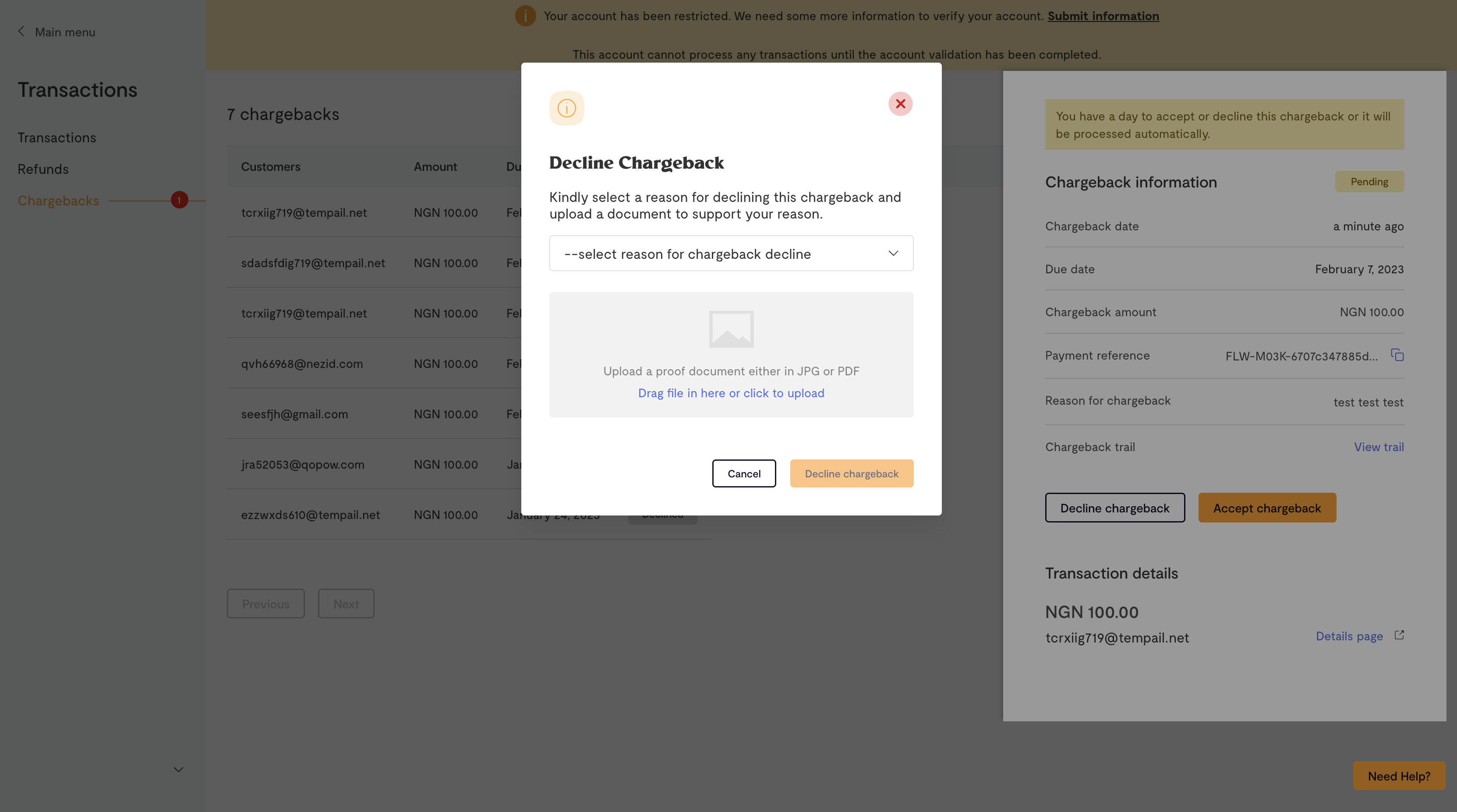

If you believe that there is no reason for the customer to be refunded, you can choose to decline a chargeback. This can be because you already previously refunded the customer or you provided the value/service the customer paid for.

When you decline a chargeback, you will be required to submit evidence and this begins the response process between You, Flutterwave, Flutterwave’s Acquiring bank and the cardholder’s Issuing bank. To decline a chargeback:

Click on the “Decline chargeback” button in the chargeback information page.

Fill in the reason for declining the chargeback. You can also upload a document as additional proof then click “Decline chargeback”.

Flutterwave will present your submitted evidence to the Acquiring bank, which reviews the information submitted and then represents the same to the Card Issuer. These are necessary steps in the evidence submission process. We will share feedback on the status of the chargeback evidence via the Flutterwave dashboard.

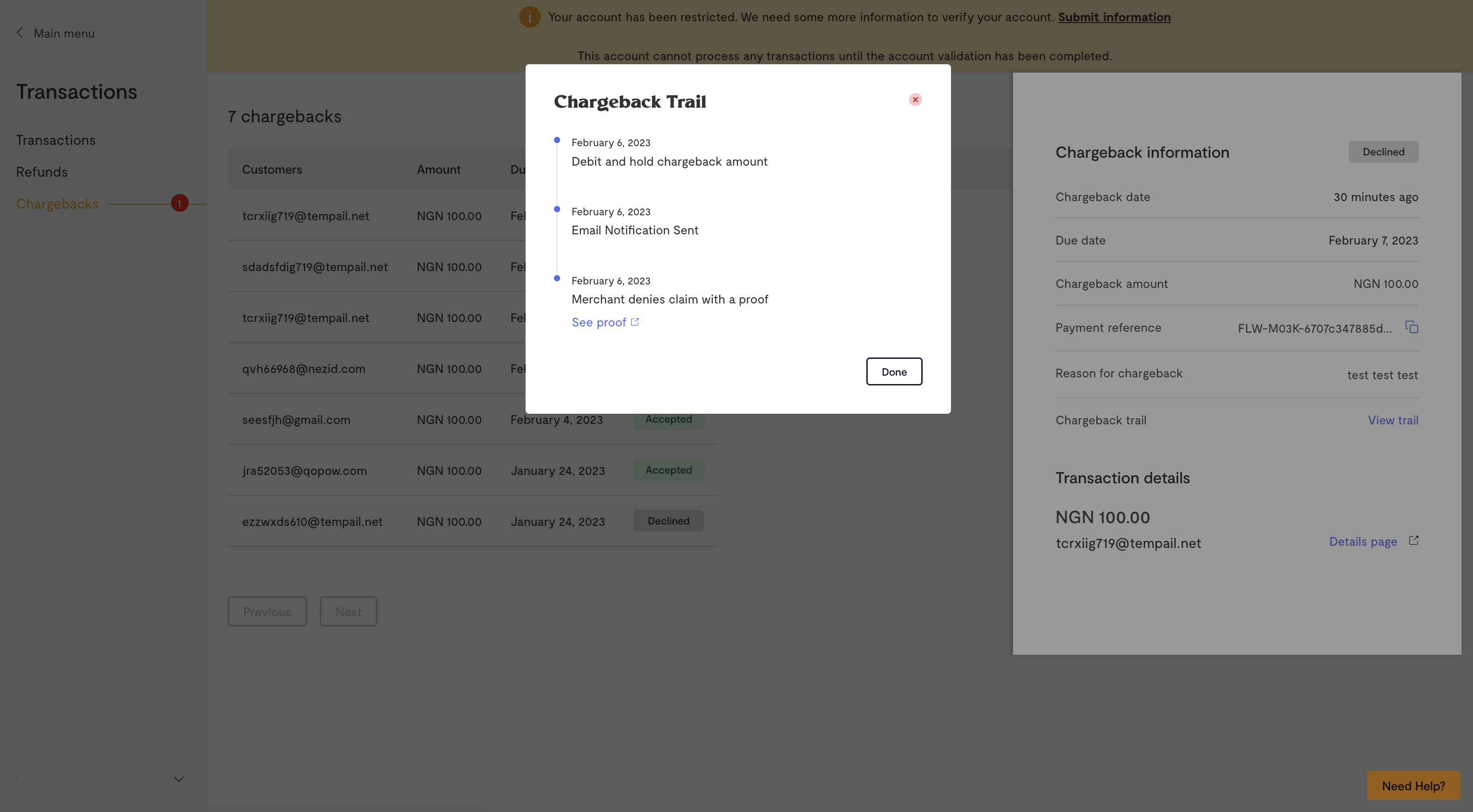

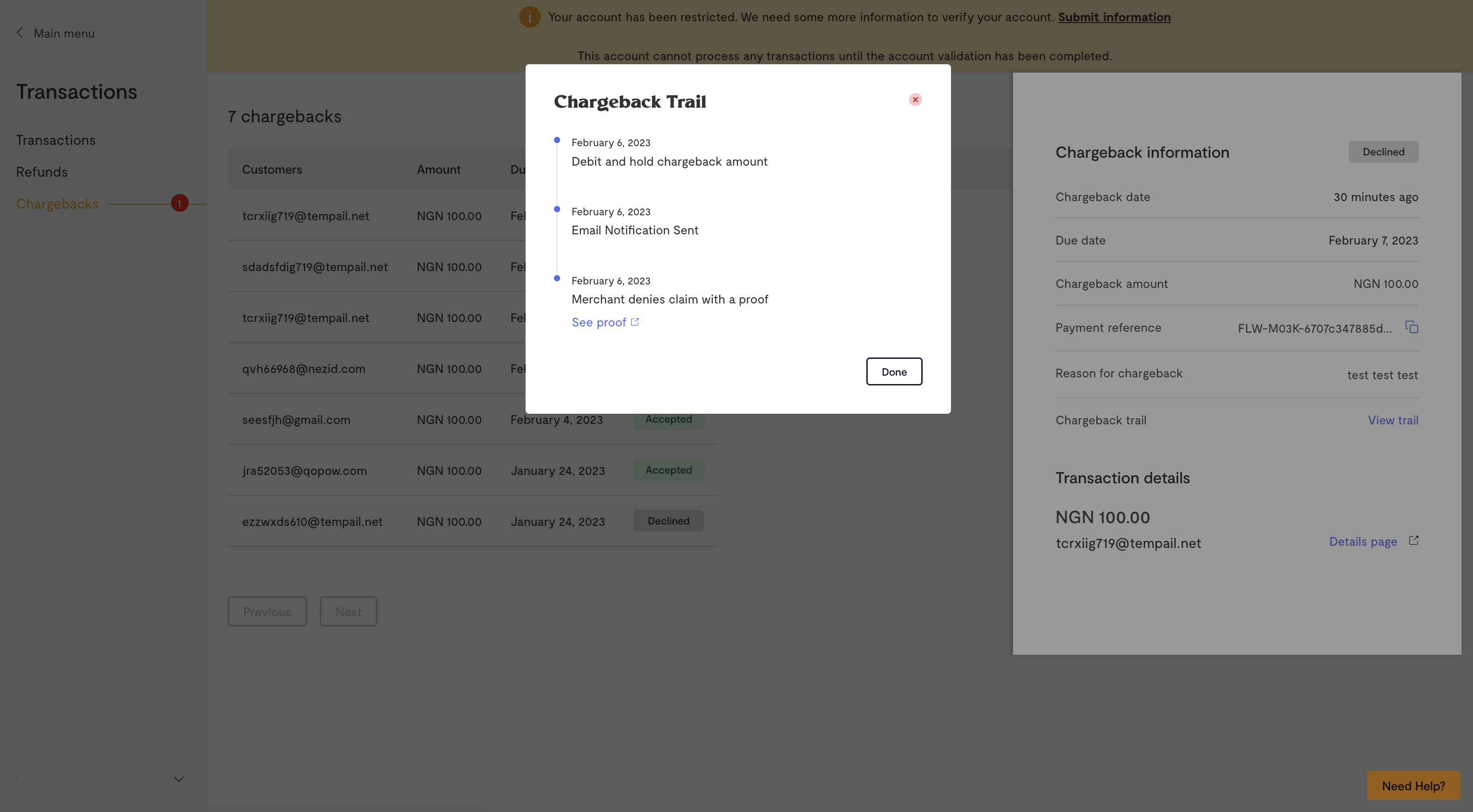

When you click “View trail”, you can see more details and feedback about the chargeback.

Chargeback evidence cycle

After uploading your evidence, you will receive an email notification about the result or status of the chargeback.

Proof is declined: The proof you upload might get declined. You can view the chargeback trail to see the reason it got declined. You can also re-submit another evidence by clicking on the Decline chargeback button again.

Chargeback won: If you win the chargeback, the status of the chargeback record will display as Won. This means that the transaction amount will not be debited from you and paid to the customer

Chargeback lost: A chargeback is lost if the evidence submitted to the card issuer has been denied and the chargeback stands. This means that the transaction amount will be debited from you and paid to the customer

We'd like to hear from you

Suggest the type of support articles you'd like to see

Still need help?

Get in touch if you have more questions that haven’t been answered here