What are Card Maintenance Fees, and why do your financial institutions keep charging you for them, even though they know you hate it?

Read this post; it’s important.

Everybody hates card maintenance fees. Even us.

But what are these fees and why do financial services businesses keep charging them even though their customers don’t like paying them?

A Card Maintenance Fee is a fee charged monthly by your card hosts on active cards, and on cards that were terminated within the 30 day period leading up to the charge.

So, if your card maintenance fee for Card A is due on April 30, and you terminate the card tomorrow, you still get charged for the month of April, but there will be no further charges from May.

Regardless of the amount, it can be the most annoying thing when that maintenance fee debit alert hits; but card providers, unfortunately, have to sometimes charge them.

Here’s why:

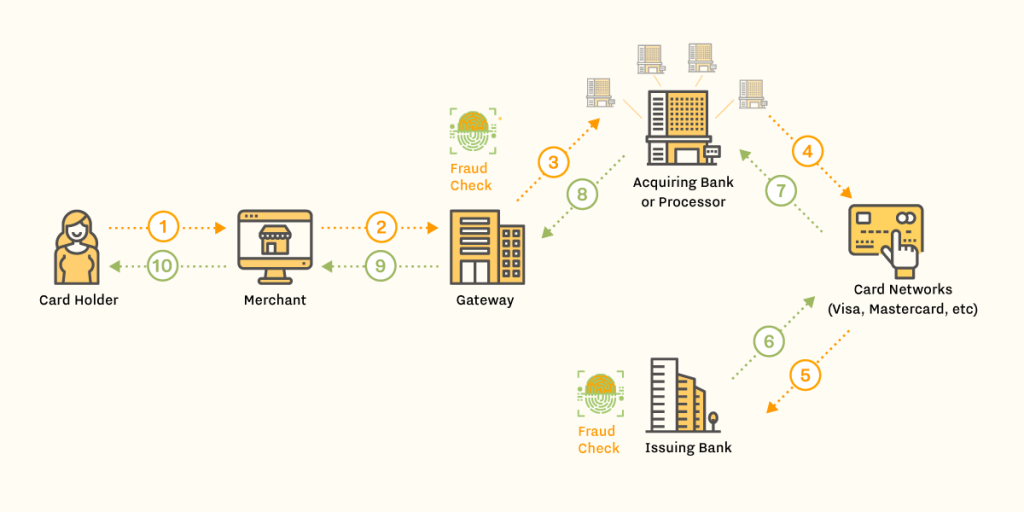

The international financial system is a large web of complicated, interdependent relationships. Peek behind the curtain and the lines between competitors begin to blur; everybody is working together to make sure your payment is successful.

It’s also these relationships that ensure that a user anywhere in the world can sit in the comfort of their home or office and pay for goods and services halfway across the world with only a series of random numbers.

For example, when you make an online or offline payment, this is an illustration of what typically happens behind the scenes in the five to ten seconds it takes to process your payment:

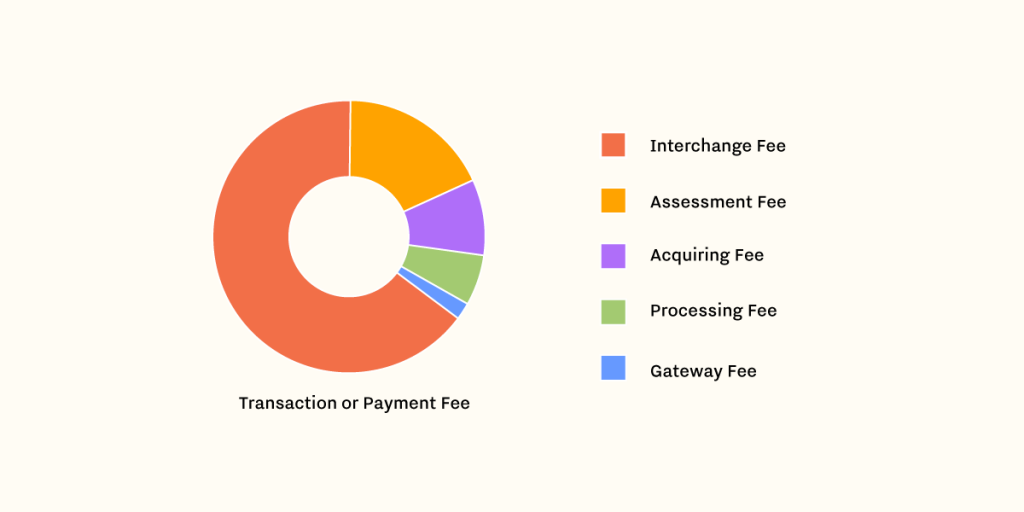

Maintenance fees are the grease that keeps this large financial services machine network going. Maintenance fees also support the businesses in the chain of transactions, but not necessarily in the way that you think.

Every time you pay a fee, it is split between most or all of the companies that enabled you to use the service, or carry out the transaction for which you are now being charged a fee.

For example, this image shows you how a typical transaction charge might be split among all the different parties that worked to make the transaction successful:

Sometimes, businesses take that inconvenience off their customers by paying the fee on their behalf. But when customer numbers grow beyond a certain point, some businesses become unable to afford the cost of these fees.

When that happens, customers might receive a message informing them that they will be charged a maintenance fee going forward. Understandably, a lot of us will be upset about having to pay fees for a product that used to be free of charge.

But in many cases, what happens is that the business splits the fee in two and pays one part, then charges the customer for the second part of the fee. It might not be the most ideal situation but it seems fair to all.

Hopefully, this has been a helpful summary of why card maintenance fees are necessary and where the charges go when we pay them.