As a developer, you’ll need to integrate a payment gateway into a website or application at some point. This could be for your 9-5 job or personal side projects, so it’s important to be well-equipped for it.

This is particularly relevant in Nigeria, where small to large businesses are increasingly moving their operations online. This means businesses will not only demand developers who can build their websites, e-commerce sites, and web applications but also integrate secure payment processing capabilities. These businesses want a seamless checkout experience that not only converts one-time customers but also assures existing customers that their transactions are secure.

In this article, we’ll discuss what a payment gateway is, how it works, and how to integrate one into your web application.

What Is a Payment Gateway?

A payment gateway is a digital service that online businesses use to process and authorize customer payments. It encrypts payment details for users, checks the provided details, and approves or rejects transactions on behalf of businesses via the Internet.

In Nigeria, a payment gateway lets businesses process payment using their banks, virtual accounts, unstructured supplementary service data (USSD), mobile money, and credit or debit cards.

How Do Payment Gateways Work?

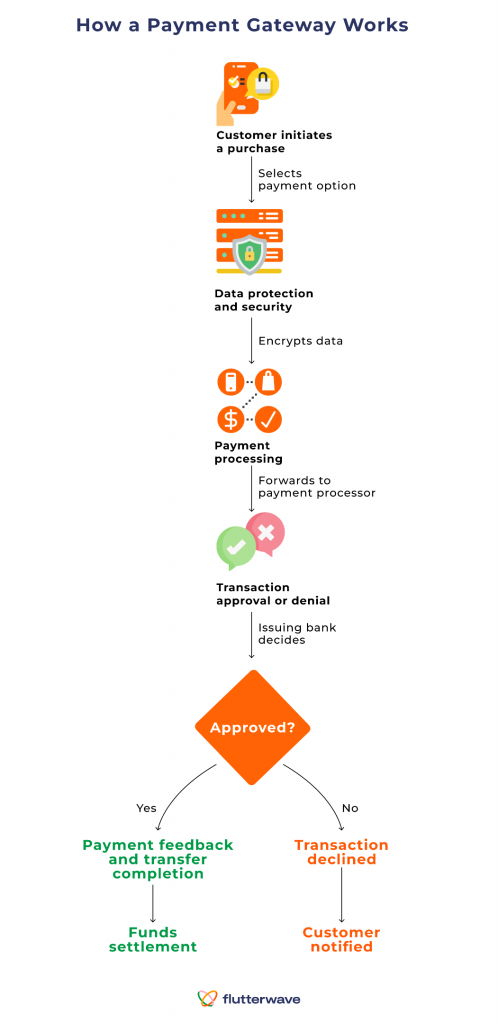

Before you learn how to integrate a payment gateway into your application, it’s important you understand how it works. Below is an overview of how a payment gateway operates:

- Customer Initiates a Purchase: When a customer makes a purchase on a website or application, they’ll be required to select a payment method and input the corresponding details shown on the checkout page.

- Data Protection and Security: The payment information will be encrypted and sent securely from the website or application to the payment gateway.

- Payment Processing: The payment gateway forwards the encrypted payment information to the payment processor, which then sends the transaction details to the card issuer or bank for transaction authorization.

A card issuer is a financial institution or a company that issues credit or debit cards to customers.

- Transaction Approval or Denial: Depending on available funds and if the customer meets the requirements and security checks, the issuing bank approves or denies the transaction.

- Payment Feedback and Transfer Completion: The issuing bank sends transaction details through the payment processor to the payment gateway. If approved, the transaction is completed, and the customer receives confirmation. If declined, the transaction is declined, and the customer is notified.

While payment gateways help businesses in Nigeria accept and process payments, it’s also important to understand the roles of payment processors and merchant bank accounts in completing a transaction end-to-end.

The Role of Payment Processors and Merchant Bank Accounts

A payment processor, also known as a payment service provider, is a company that acts as a mediator or intermediary between a bank and a business during a transaction. Basically, the payment processor communicates the customer’s payment intent—whether through a card, bank transfers, or any supported payment method to the business’s bank.

A merchant bank account is a type of bank account that the business must set up and provide to payment gateway providers for processing approved transactions for settlement.

There are also fees associated with facilitating payments, such as transaction fees and chargeback fees. Payment processors may charge these fees directly or indirectly through the payment gateway or acquiring banks.

How to Select a Payment Gateway in Nigeria

Another important decision when integrating a payment gateway into your website or application is selecting the right provider. Before making your choice, consider the following:

- Fraud Protection: Ensure that the provider you’re going with is secure and has fraud prevention baked into their payment flow.

- PCI Compliance: If the businesses you’re building for want their customers to save card information, ensure the provider is secure, authorized to handle such sensitive data in compliance with PCI standards, and licensed by the Central Bank of Nigeria as a payment service solution provider (PSSP).

- Compatibility: Make sure the provider supports the frameworks, libraries, and application types you’re working with and can accept payments.

- Transaction Fees: Consider the associated charges. Select a payment provider whose payment processing fees align with the business budget while offering the necessary features needed for your project.

- Multi-Region Support: If the business you’re building for wants to support domestic and international payments, ensure the payment gateway provider supports and accepts payments across the business region and can perform other international transactions.

In Nigeria, you’ll see a number of options to choose from when it comes to payment gateways, and it can be challenging to choose the right one. Some may meet one or two of your criteria, depending on the size of your project and specific use case.

Flutterwave stands out as a best-in-class option. It offers a wide range of services that cater to both developers and businesses for seamless payment processing, including accepting payments, mobile payments, and providing comprehensive payment solutions. Additionally, Flutterwave enables you to process international payments in Nigeria.

How to Integrate Flutterwave Into Your Website or Application

Integrating Flutterwave into your website or application involves several steps that are typically straightforward, as shown below:

- Create a Flutterwave Account: Navigate to the sign up page and fill in the required form to create an account.

- Get Your API Keys: After creating your Flutterwave account, you’ll need the API keys to authenticate transactions and securely communicate with Flutterwave’s server. Navigate to the API keys section under the Settings menu to obtain them.

- Select an Integration Method: Flutterwave supports multiple methods to help integrate payment into your application. Depending on your need, you can select from any of the methods below:

| Payment Method | Description |

| HTML checkout | Payment done with only HTML form containing payment details. |

| Flutterwave Inline | Use a lightweight JavaScript library to process payment on your checkout page. |

| Frontend SDKs and plugins | Use Flutterwave’s SDKs and plugin with your favourite frontend frameworks and libraries to process payment. |

| Backend SDKs | Use Flutterwave’s backend SDKs with favourite backend frameworks and libraries. |

| Mobile SDKs | Use Flutterwave’s mobile SDKs with your favourite mobile frameworks. |

| Flutterwave Standard | Process payment from your server using Flutterwave’s endpoints |

- Process Payment and Test: Using any of the payment methods, you can integrate a payment gateway into your website or application and test your integration using Flutterwave’s mock data to simulate real-world transactions.

- Handle Errors and Edge Cases: Implement a robust error-handling mechanism to deal with unsuccessful payments, expired cards, and other payment-related issues.

- Go Live: Once you’re confident with the payment gateway integration, have addressed error cases, and have thoroughly tested all scenarios, complete your KYC process, go live, and accept online payments.

Next Steps

Flutterwave is committed to automating your payment needs, from ad-hoc to recurring. We offer a robust suite of products and APIs to help you move quickly and build financial services efficiently.

If you need further support or additional clarification, we have a dedicated team to cater to your needs and help you every step of the way. Reach out to Flutterwave support to get started.

You can also join our Slack community to stay up-to-date with our latest developments and connect with a vibrant network of users and developers.