Today, we live in a world where value is exchanged electronically. Goods and services are delivered to you with just a click or swipe but one thing that is constant is that all the payments you make pass through a payment gateway, which facilitates and ensures that the exchange of “money for value” is securely done online.

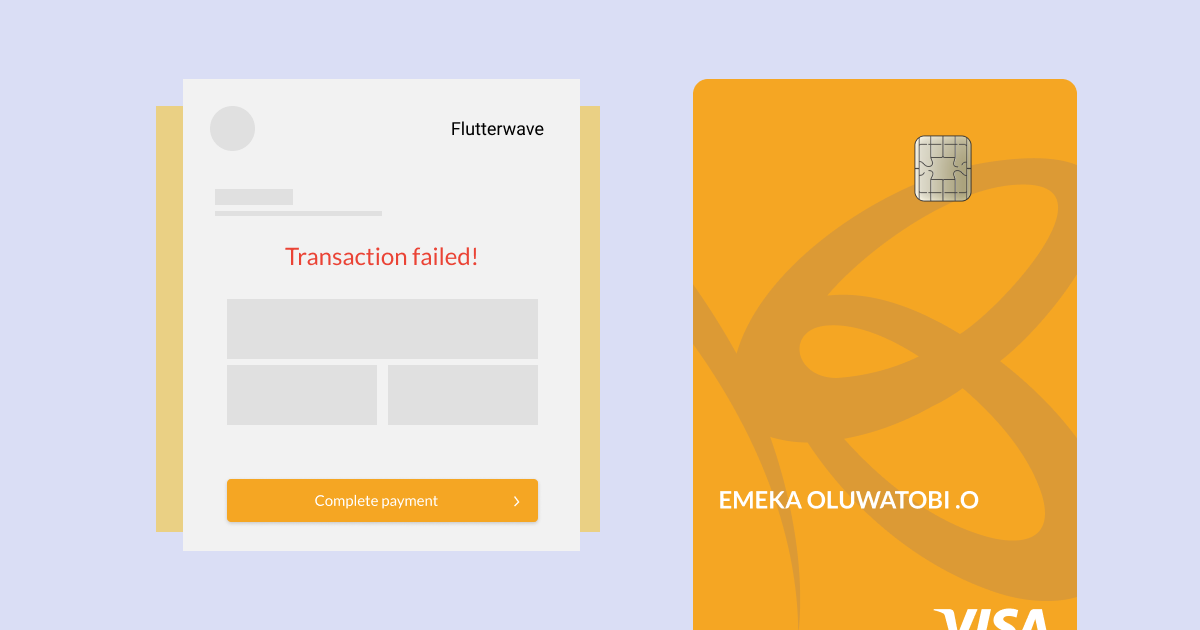

If you are familiar with online transactions, then you are probably no stranger to failed payments and the frustrations that you experience because of them.

There are a ton of reasons why you may experience a failed transaction, we’ve picked out 5 common reasons your card payments fail online and what you can do about it.

1. USING AN INVALID TOKEN

A token payment is a solution that secures a customer’s payment details as a Token ID – it is mostly used in situations where you have to make recurring payments for subscriptions and membership fees. With your consent, the vendor is able to make a direct debit on your card with your saved card details and issues you a set of numbers known as – “Token”. This Token is presented when you need to make subsequent payments.

One very common way to have your transaction fail is to input the wrong or expired token number when trying to make a recurring payment. When this happens, your payment provider will display a message similar to this:

“invalid token supplied”

- When you put in the wrong or expired token details repeatedly, this could be seen as a security threat by the payment platform and you could have your account temporarily suspended or even worse, disabled. To prevent this from happening, you can follow these steps: Always ensure you type in the right token ID, you could write it down somewhere safe like – your notes, email draft or use your browser’s password autosave feature.

- Check-in with the service you are using to verify your token’s validity. Will it expire? Can it be renewed? What happens if you opt-out for some time and return?

2. FAILURE TO AUTHENTICATE A CARD PAYMENT CORRECTLY

When you are making a payment online, there are a few layers of security. First, your card issuer will verify your details, that is, the card number, type, CVV, expiration date, name and card billing address. Once that has been verified, the next step will be for you to input your PIN or your OTP(one time password) which will be sent to your verified email address or your phone number by your card issuer.

The OTP is only valid for a few minutes and if you fail to input the OTP at the required time or you input an incorrect OTP, the transaction will fail with the message: “Authentication Failed”.

In some cases, you might not receive your OTP on time or at all. Some debit cards are not enabled to receive OTPs especially if it has never been used for an online transaction before. If this is the case, you should contact your bank or card issuer asking them to enable your card to receive OTPs.

3. INSUFFICIENT FUNDS

This is the most common error you could come across when you are paying online. You’re ready to pay for a product or service & after inputting and verifying your card details, you get one of the following error messages:

“Not enough funds”

“Insufficient funds”

“Card declined: Insufficient funds”

This message simply means you do not have enough funds to carry out the transaction. As a customer, this can be a little embarrassing. You might have to fund the account your card is linked to so complete the payment. Sometimes, you can get charged for using a credit card with insufficient funds to make a transaction. If you are in the US, you probably know that for checks that can’t get cashed out due to insufficient funds, U.S banks could impose a penalty ranging between $27 – $35.

If you are a business owner, this could be frustrating and inconvenient especially if it’s a recurring payment.

What can you do?

As a business, have an automated email service, prompting customers with a polite enquiry as to why their payment failed due to insufficient funds. If it’s a recurring payment, you could also try recharging the card at a different time.

As a customer, the important thing to do is to make sure you have enough money to complete your transaction. You can have a mobile application that helps you view your account balance or enable notifications for whenever a debit or credit occurs on your account.

4. EXCEEDS WITHDRAWAL LIMIT

Whenever a card transaction fails and the error message returned is “Exceeds withdrawal limit”, it means that the account linked to that card has exceeded its daily limit. Most card issuers will put a daily spending limit on a card to protect you as the customer from fraud and theft.

If your business processes large volumes of money this can be quite frustrating. To get around this, the customer has to meet with their card issuer or bank requesting for an increase in their daily limits.

5. AN EXPIRED CARD

If a card transaction fails and you receive one of the following error messages:

“Expired Card”, “Expired Card, Capture” or “Sorry, this card is expired”

It means that the card you are trying to use to complete the transaction has expired. To avoid this, periodically check your card to confirm the expiry – you can also set a reminder for yourself on your phone or calendar, a month or two before your card expires so you can get a new one. to destroy the old card before disposing of it for safety reasons, you definitely do not want other people having access to your personal information.